Your Pie – Understanding & controlling each slice of the pie

The 5 Uses of money

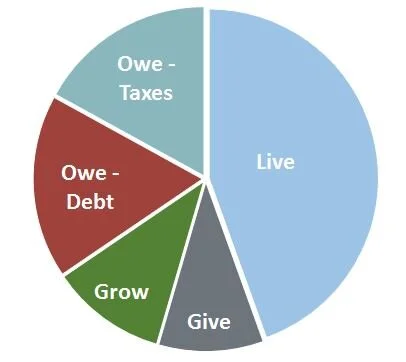

When it comes to managing your personal finances managing cash flow to accomplish your goals is a big part of it, but doing so doesn’t have to feel restrictive or overly complicated. Think of your expenses as falling into 5 categories (the five uses of money). If you then think of your income as a pie and each of the five uses of money (Live, Give, Grow, Owe- taxes, Owe- Debt) as a slice of that pie, you can begin to understand the interconnectivity of managing cash flow and that your spending decisions have.

If you increase one slice of your pie you must reduce the size of one or more of the others -conversely if you reduce one, than there will be an increase in another. Over time the size of your pie (your income) may increase, but for most of us the size of our pie is the size of the pie we have today.

The bible provides wisdom for any size of the pie, providing you with a guideline for making decisions for each slice of your pie.

Knowledge is Power

If you don’t know how you are currently spending your income how can you make the decisions that are best for you and your family?

We say knowledge is power – the power to make wise decisions. So take the time to understand how your spending (or use of money) impacts your success and may be limiting other slices of your pie.

In this way you can begin to take the steps needed towards achieving your financial success.

Your "Grow" (savings)

The “Grow” slice of your pie, or the level of your ongoing savings, will help determine when and if you can achieve your intermediate and long-term goals or priorities. After all, those priorities were most invariably included in your personal definition of "success."

To increase your “Grow” you need to spend less than you earn by controlling spending on lifestyle, which in turn has the potential to reduce your debt and therefore lower your monthly debt payments. The result is more left over to save, increasing your “Grow” slice and overall financial health.

Our planning seeks to help our clients gain perspective on money, apply these biblical principles to their unique situation and take the steps necessary to achieve their financial goals. Learn more about our firm.